Fat-Tailed Distributions: Data, Diagnostics, and Dependence

Experts discuss the unique features of fat-tailed risks and how to model them.

Fat tails have entered popular discourse largely thanks to Nassim Taleb’s book The Black Swan: The Impact of the Highly Improbable (Random House, 2007). The “black swan” is the paradigm-shattering, game-changing event. But are black swans really unpredictable bolts from the blue or rather evidence of the shortcoming of traditional statistical tools?

In a new RFF discussion paper, RFF Senior Fellow Roger Cooke and Daan Nieboer highlight the unique features of “fat-tailed” phenomena. Examples of distributions exhibiting fat tails include flood damages, crop losses, natural disasters, and hospital discharge bills.

For example, prior to 2005, the most costly hurricane in the United States was Hurricane Andrew (1992) at $41.5 billion USD (2011). Hurricane Katrina set the next record—over twice as costly, at $91 billion USD (2011). This is in contrast to a “thin-tailed” distribution, such as human height (wherein the tallest human is not going to be twice as tall as the second tallest).

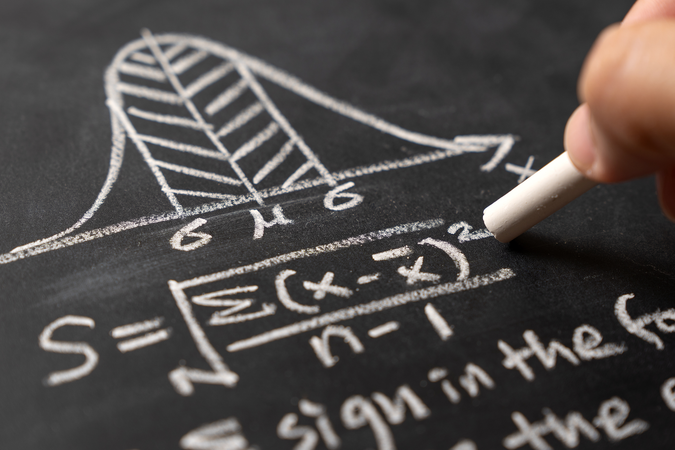

Prognosticators who base their predictions on historical averages will be blindsided when dealing with fat-tailed risks. As Cooke and Nieboer write, “heavy tail phenomena are not incomprehensible bolts from ‘extremistan’, but arise in many commonplace data sets. They are not incomprehensible, but they cannot be understood with traditional statistical tools. Using the wrong tools is incomprehensible.”