Offset Reform Could Drive Investments in Nature-Based Climate Solutions

This issue brief explores a potential reform to California’s carbon market to generate more investment for nature-based climate solutions.

Main Finding

Procurement of nature-based climate solutions to supplement or substitute the existing offset program could additionally yield hundreds of millions of dollars in expanded investments and achieve a fuller range of environmental and community-based benefits.

1. Introduction

As recent events have shown, the impact of climate change on affordability for California households substantially dominates the cost of efforts to reduce greenhouse gas emissions. An important opportunity to mitigate emissions exists on natural and working lands. These investments also can improve the state’s resilience to the changing climate. These opportunities are not directly regulated under the carbon market because of the difficulty in monitoring and enforcing regulatory actions. Instead, the market directs investments through the offset program. A potential reform to the offsets program could yield additional hundreds of millions of dollars for the Greenhouse Gas Reduction Fund to drive further investments.

2. A potential for offset reform

Offsets credits are issued by the California Air Resources Board to qualifying projects that reduce or sequester greenhouse gases from sources not subject to a compliance obligation under the cap-and-trade program. Offset credits can be used as compliance instruments, in lieu of emissions allowances, under the program.

An important aspect of offsets in the carbon market is to direct resources to sectors that are not directly regulated in the cap-and-trade program. The investments that result contribute to achieving the state’s overall climate and ecological objectives. Forestry projects have contributed most of the offset credits to the program. A second important aspect of offsets is to provide cost-containment and compliance flexibility for entities covered by the cap-and-trade program, because offsets can be obtained at a lower cost and price than emissions allowances; hence offset use offers a lower cost means of compliance for emitters in the carbon market. Offset usage by individual facilities is limited. Through 2020, the offset limit was set at 8 percent, and this was reduced to 4 percent beginning in 2021. Beginning in 2026, the offset limit will increase back to 6 percent.

The opportunity to use offsets in place of emissions reductions at regulated facilities also has attracted criticism. One concern is that a large share of the investments that earn offset credits occur out of state, and related investments may not directly benefit the California economy. Starting in 2021, at least half of the offsets must provide direct environmental benefits in the state, although projects do not necessarily have to be in the state. At the same time, the quality and permanence of forest offsets remain important questions (Badgley et al., 2022).

We use the history of changes in the offset limit including its increase again in 2026 as an opportunity to explore potential improvement to the program design through the introduction of public procurement of nature-based climate solutions with revenues from the Greenhouse Gas Reduction Fund. Procurement could be a supplement or substitute for elements of the current program and be paid for with value redirected from private acquisition of offset credits as is currently practiced.

There are several reasons why procurement might outperform market-driven investments in offsets in achieving California’s climate targets. There is a vast untapped opportunity for carbon mitigation on natural and working lands. However, criticism that offsets lack integrity inhibits investments. A large share of the annual offset limit is unutilized, as many compliance entities prefer to rely on higher-priced allowance transactions. A procurement process might do a better job of ensuring the integrity of these investments and better realize the potential contribution of nature-based solutions to addressing climate change. Criticism of offset use also has harmed confidence in the carbon market generally. State procurement could boost confidence and help forge social consensus for strengthening the market.

Procurement might also help to contain costs in the carbon market, because the cost of a carbon credit is less than the price of an emissions allowance. The sale of a single allowance through the allowance auction would yield revenue sufficient to acquire more than one ton equivalent of offset credits. That is, public procurement could expand carbon mitigation. The benefits might accrue as cost savings. Mitigation credits resulting from procurement could be cancelled, which would accelerate emission reductions; they could contribute to the price ceiling reserve; or they might be used to expand the buffer pool that provides insurance for potential reversals of biological sequestration.

A procurement process also could improve fairness among compliance entities. Currently, the cost advantage of offsets accrues mostly to the larger emitters. Small emitters are less likely to capitalize on offsets for compliance; overall under the 8 percent offset limit, only 7 percent of compliance obligations were met with offsets between 2018 and 2020 (Leard and Munnings 2024). A procurement process could lead to a more even distribution of costs and cost savings.

Moreover, a scientifically informed procurement process could more fully realize the environmental benefits of investments in nature-based climate solutions by comprehensively evaluating the full range of attributes of potential investments including biodiversity and community benefits in addition to cost savings. Procurement could be implemented through reverse auction to improve the cost-effectiveness of nature-based mitigation investments. The reduced role for market-purchased offsets as compliance instruments would motivate greater mitigation from emitting facilities and greater emissions reductions in and near disadvantaged communities.

We use RFF’s Haiku Emissions Market model to estimate the changes in allowance prices and auction revenues that would result from a change in the offset limit under three possible scenarios. Subsequently, we calculate how many offset credits might be obtained through a procurement process with those revenues. We assume throughout that the eligible offset limit is fully exercised and the offset limit is realized by all entities.

Scenario 1: Reducing the offset limit to 4 percent from 2031 onward.

As a default assumption, we anticipate the offset limit which is set to rebound to 6 percent in 2026 will be maintained at that level after 2030. In Scenario 1, we assume it is reduced back to 4 percent in 2031.

In the presence of an allowance bank, the allowance price in any year depends on the cumulative supply of allowances through 2045. Table 1 reports that this reduction in the availability of compliance instruments leads to zero increase in the allowance price in 2025 under the less realistic low allowance demand (identified above as the Scoping Plan level–SP), because the price is at the price floor. However, auction revenue is affected because more allowances will sell at the price floor and the price rises off the price floor earlier than it would otherwise.

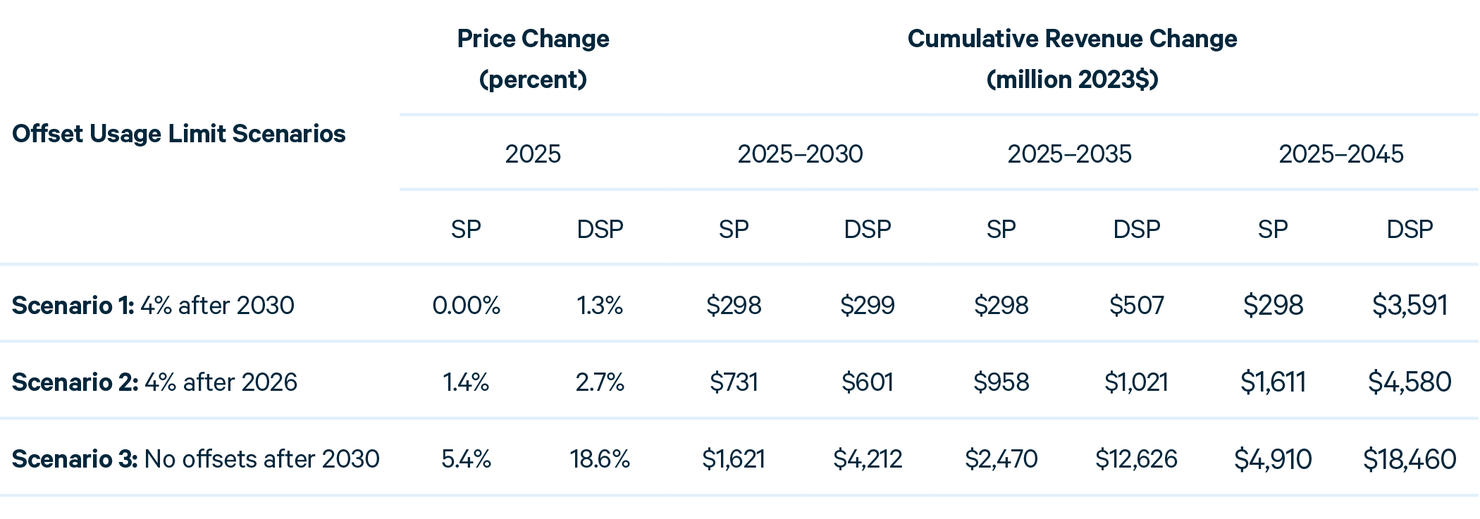

Table 1. Allowance price and auction revenue changes from changes in the offset limit.

SP: Scoping Plan Scenario (Low Allowance Demand/Price Scenario)

DSP: Delayed Scoping Plan Scenario (High Allowance Demand/Price Scenario)

Under the likely more realistic high allowance demand level (Delayed Scoping Plan–DSP), the model estimates a default price without changes to the offset limit of $45.37. Under Scenario 1, the price increases by 1.3 percent ($0.60) and reaches the Allowance Price Containment Reserve earlier than it would otherwise, bringing additional allowances into the market at that point. These price effects are distributed across all years starting in 2025, even though the offset change occurs in 2031, due to changes in banking behavior in anticipation of the policy.

Cumulative auction revenues under the SP and DSP demand levels between 2025 through 2030 total $300 million. It is noteworthy that revenue changes under low demand (SP) are front-loaded and realized fully in 2025 because of additional sales at the price floor and the price path over time is not affected. In contrast, additional revenues are realized incrementally under the high demand (DSP) level and total $225 million over the five-year period from 2026 through 2030. From 2026 through 2035, cumulative auction revenues total $300 million under the SP demand level and $500 million under the DSP demand.

Scenario 2: Precluding the offset limit from rising above 4 percent from 2026 onward.

In this scenario, we estimate that limiting the eligibility to use offsets to 4 percent in 2026 onward would increase the allowance price in that year by 1.4 percent under the SP demand level and by 2.7 percent ($1.28) under the DSP demand level. Auction revenue would increase by $700 million cumulatively from 2025 through 2030 under the SP demand level and by $600 million under the DSP demand level.

Scenario 3: Eliminating offsets from 2031 onward.

In this scenario, we assume that all offset credits earned before 2031 have been used and none are carried forward, and that offsets are eliminated as a compliance instrument from 2031 onward. Under the SP demand level, the allowance price in 2025 increases by 5.4 percent, and under the DSP demand level, it increases by 18.6 percent ($8.43). Cumulative revenues from 2025 through 2030 total $1.6 billion under the SP demand level, and $4.2 billion under the DSP demand level.

A change in the offset limit would affect revenues in different ways under the low allowance demand level (SP) and high demand level (DSP) due to interactions with the price floor and Allowance Price Containment Reserve, as reported in table 1. Under low allowance demand, revenue changes are front-loaded and largely or fully realized in 2025. Under the high allowance demand, revenue changes accrue incrementally.

The market exchange price of generic offsets that do not prioritize direct environmental benefits to the state is less than the price of an emissions allowance, but both have the same value for compliance purposes. From 2021-2023, allowance prices were 60–70 percent greater than the price of a generic offset credit (Leard and Munnings 2024; IEMAC 2025). On this basis, which we describe as DEB Low, redirection of expenditures away from offsets and toward investment in mitigation credits through the GGRF could yield 160-170 percent greater investment in natural and working lands.

If procurement were imagined driving higher-valued investments that prioritize in-state environmental benefits, it might be more appropriate to compare to the price of offsets that deliver direct environmental benefits. Allowance prices from 2021-2023 in this case, which we describe as DEB High, were 28–57 percent greater than high quality offset credits. Redirection of expenditures away from offsets with direct environmental benefits to mitigation credits through the GGRF could yield 128-157 percent greater investment.

Important qualifications point in opposite directions regarding these estimates. On the one hand, procurement processes consume public and private resources. However, the offset market also has transaction costs, which Leard and Munnings enumerate as monetary and non-monetary costs, such the time/effort cost of locating an offsets supplier. On the other hand, a reduction in the offset limit reduces the number of compliance instruments and pushes up the allowance price. As we describe above (Table 1), this leads to increased revenue from the sale of allowances under ex ante allowance budgets.

The net change in mitigation tons from natural and working lands resulting from a reduction in the offset limit and an associated investment of resulting increases in the GGRF is positive in most cases we examine. Figure 1 reports outcomes for the low allowance demand (SP) and high allowance demand (DSP) levels under the three offset credit reduction scenarios and the two cases describing the range of ratios of allowance prices to offset credit prices. Each case shows four results for the range of the ratio of allowance prices and offset credit prices. Generally, when allowance demand (and allowance prices) is low (SP), the shift to procurement leads to a relatively smaller increase or a decrease in mitigation. It always leads to an increase in mitigation at the more realistic DSP demand level. In all other cases except one the mitigation tons increase. To focus on the most modest reform, Scenario 1, which returns the offset limit to 4 percent in 2030 in the most realistic high demand level (DSP) case, we find an increase in mitigation tons of 2-15 million tons through 2045 would result.

Figure 1. Change in mitigation (million tons) on natural and working lands from procurement through the Greenhouse Gas Reduction Fund

3. Tapping nature-based solutions

Offsets in California’s cap-and-trade program provide valuable functions through promoting investments outside the carbon market and cost containment in the market. They have also been the point of criticism that has weakened support for the program.

A potential reform would reduce the maximum number of offsets that can be used for compliance by a regulated entity, and channel investments through procurement. This change would reduce the total number of compliance instruments available for compliance and push up the allowance price and auction revenues, contributing proceeds to the Greenhouse Gas Reduction Fund. Recognizing the lower cost associated with mitigation on natural and working lands, we calculate how these proceeds could be invested through a multi-attribute procurement process that holistically reflected the state’s biodiversity goals and community benefits along with more robust nature-based climate solutions. In most scenarios and cases, we find this reform could increase net investments.

The carbon market is typically the most cost-effective tool within the state’s climate policy portfolio for achieving emissions reductions. The greater the mitigation that can be achieved through the market the greater the affordability for households.

The proposed reform could expand mitigation that is achieved through the carbon market and could boost confidence and public support for the market. However, its efficacy would hinge on an efficient, science-based procurement process. A modest trial could provide an experiment to develop a template to improve climate-related investments in California and possibly provide a template for other jurisdictions, fulfilling one of the directives of the original AB 32 Global Warming Solutions Act of 2006.