How USDA Conservation Programs Mitigate Agricultural Greenhouse Gas Emissions

This issue brief, part of a series on agricultural greenhouse gas emissions policy, provides an overview of conservation programs in Title II of the Farm Bill.

Key Points

- Title II of the Farm Bill authorizes several US Department of Agriculture (USDA) programs that provide financial incentives and technical support for increasing environmental protection on working agricultural lands and for taking lands prone to degradation out of use.

- Although the focus of these programs for many years in the past was mainly on soil and water conservation and other traditional environmental objectives, the focus changed markedly to reducing agricultural greenhouse gas (ag-GHG) emissions with the appropriation of billions of dollars specifically for reducing ag-GHG emissions in the 2022 Inflation Reduction Act.

- Since participation in Title II programs is voluntary, and participating farmers and ranchers share with the government in the cost of conservation measures (including measures for reducing greenhouse gas emissions), farmers and ranchers must obtain some direct economic benefit from participation, net of cost. Net economic benefits can vary substantially, depending on the activities implemented, farm or ranch characteristics, and the cost shares.

- Although USDA has evidence on the reductions in greenhouse gas (GHG) emissions that may occur with various changes in agricultural practices, the net economic benefits to undertake those changes are uncertain and variable.

- Consequently, the scale of GHG reductions from increased funding for Title II programs also remains uncertain—though there is reason to believe that the reductions could be significant with adequate incentives to implement effective changes in agricultural practices.

- Several important issues regarding GHG mitigation and the future of Title II programs will be addressed in the 2023 reauthorization of the Farm Bill. They include:

- How much funding will be approved for activities targeted at reducing ag-GHG emissions in Title II? The answer will affect net economic benefits, take-up of mitigation measures, and ultimately, emission reductions.

- How will access to Title II funding be distributed among agricultural producer groups? The answer will have important equity and fairness implications.

- What changes might USDA be required to undertake to strengthen the implementation of Title II programs? The answer will affect both take-up of mitigation measures and equity.

- What links may be established between crop insurance eligibility or pricing and implementation of more resilient agricultural practices?

Special Series: Agricultural Greenhouse Gas Emissions Mitigation Policies

This issue brief is part of a series on policies, programs, and technologies for reducing greenhouse gas emissions from the US agricultural sector. In the runup to Farm Bill reauthorization, RFF Research Associate Emily Joiner, RFF Senior Fellow Michael Toman, and RFF Fellow Suzanne Russo review the tools available to the federal government for measuring and mitigating emissions. Read the other installments in this five-part series:

1. Introduction

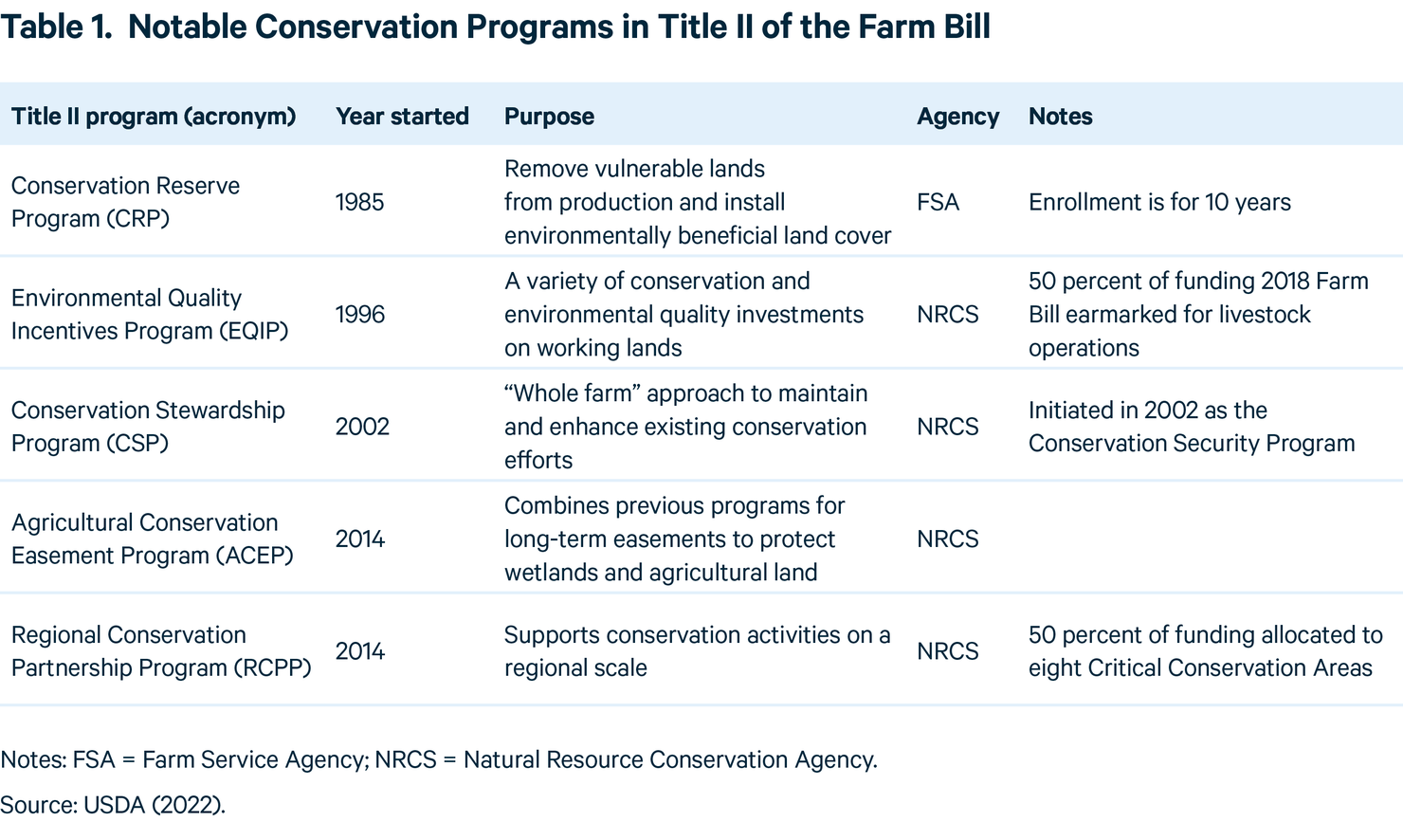

The Farm Bill, which was set up to be reauthorized roughly every five years, is a key piece of US legislation that secures funding for agricultural and food programs. Resource conservation efforts have been a part of the Farm Bill since it was first passed in 1933 in response to the circumstances that led to the Dust Bowl. Table 1 lists noteworthy conservation programs that have been added to the Farm Bill over the years. Under Title II of the 2018 Farm Bill, the Natural Resources Conservation Service (NRCS) at the US Department of Agriculture (USDA) administers most of these programs, focusing on improving environmental practices on working lands. USDA’s Farm Service Agency (FSA) administers the Conservation Reserve Program (CRP), which seeks to reduce environmental side effects of agriculture by providing incentives to remove certain lands from agricultural uses.

For several decades after the first Farm Bill was passed, programs focused on soil conservation and protection of water resources. More recently local air quality and protection of ecosystems and species habitats have been added to the list of conservation goals. Title XXIV of the 1990 Farm Bill incorporated legislation calling for USDA and the agricultural community to address agriculture and climate change (Coppess 2022). However, only since provisions in EQIP were modified in the 2008 Farm Bill has there been explicit attention to activities that reduce greenhouse gas (GHG) emissions. Other conservation activities might provide GHG emissions reductions as a co-benefit. For example, protecting soil health can reduce carbon dioxide emissions by increasing soil organic matter and removing land from production via CRP can increase aboveground carbon dioxide sequestration from the regrowth of shrubs and trees.

This issue brief first provides a brief overview on how the Title II programs currently operate and how agricultural greenhouse gas (ag-GHG) mitigation is addressed in the programs. The issue brief then considers the state of knowledge regarding the impacts of the programs. This is followed by consideration of some questions related to participation incentives and potential impacts, and some possibilities for strengthening them. In the final section of the issue brief, we highlight some key issues to be resolved in the course of reauthorizing the Farm Bill.

2. Overview of Title II Conservation Programs

Individual states set priorities for implementation of Title II conservation programs (the CRP administered by FSA and programs administered by NRCS), including priorities for reducing ag-GHG emissions. As a result, programmatic implementation can look different from state to state. CRS (2022) provides additional details on the programs.

To allocate funds for land retirements and soil protection under the CRP, the FSA scores parcels offered for enrollment in the CRP using an environmental benefits index that weighs different land attributes and the size of payment needed for retiring the parcels. FSA uses a system of standard payment rates based on average land productivity in the county where a parcel is located.

Before enrolling in a Title II conservation program administered by NRCS, a farmer or rancher may consult with a local NRCS conservation planner to learn about options for NRCS support. After filing an application, the farmer or rancher meets with a conservation planner to identify the appropriate options to implement, considering the cost the farmer or rancher would have to pay. Applications are ranked based on NRCS assessments of anticipated environmental benefits and implementation costs.

For the proposals it selects, the NRCS offers contracts to the farmers and ranchers that specify the amount and timing of funding to be provided by NRCS, and the obligations of the farmer or rancher in terms of required investments and practice changes. Funding provided in a contract with NRCS can be increased based on changes over time in regional cost indexes (though not for site-specific cost increases). Because the NRCS programs incorporate multiple conservation and environmental objectives, conservation contracts can highlight several goals. A conservation contract that focuses primarily on ag-GHG mitigation activities still can provide co-benefits such as improved water quality from nutrient management and enhanced farm resilience to climate shocks (Feng and Kling 2005; Du et al. 2022).

The 2022 Inflation Reduction Act (IRA) departed from the prior emphasis on traditional natural resource conservation objectives in NRCS programs. Sections 21001 and 21002 of the IRA provide a little over $18 billion in additional funding for GHG mitigation activities in these programs through fiscal year 2026. By way of comparison, about $19 billion in total funding for all purposes was provided in the 2018 Farm Bill for the four NRCS programs mentioned in Table 1 (CRS 2019, Table 2). This is the first time that substantial funding for Title II programs has been explicitly linked to the goal of ag-GHG reduction. The IRA also provides $1 billion for the NRCS to provide technical assistance for ag-GHG mitigation, and $300 million for improved ag-GHG monitoring and measurement.

3. Participation Incentives

Title II programs are voluntary: it is up to farmers and ranchers to decide if they want to accept the terms of proposed conservation contracts. The willingness of farmers and ranchers to enroll depends on the amount of direct benefits they may receive from participating, such as increased land productivity or lower operating costs, relative to the share of costs they must pay. Unless the direct benefits are large or the required cost share is low (or both), take-up of changes in agricultural practices and emission reductions will be limited.

While farmers and ranchers must carry out the investments and practice changes stipulated in conservation contracts, they are not required to achieve specified quantities of ag-GHG reductions with the practices they have agreed to implement. (Pre-contract estimates of potential GHG mitigation are used (along with other criteria) to rank the requests for funding.) Nor are farmers and ranchers rewarded (at least directly) for achieving larger reductions than might have been expected. Thus, the conservation agreements do not provide incentives for farmers and ranchers to improve implementation of the agreed practices “beyond the norm.” Nor do they provide incentivizes to find and try new and potentially risky alternative approaches for ag-GHG mitigation, except insofar as agency cost-shares are higher for promising but riskier options that already have been identified as eligible for support.

Incentives to participate in the CRP depend on the payments made by FSA for enrolled land (rental payments and cost-share payments for establishing a conservation regimen on the land), relative to the value of working the land. Participation also is affected by a cap on total land area allowed to be enrolled in the CRP, which can deter efforts to enroll. The cap reflects the high aggregate expenditures made by the government for CRP, with offers to enroll land—including offers from retired farmers—routinely exceeding CRP’s funding capacity.

Incentives for participating in NRCS programs to reduce GHGs depend on the direct economic returns to farmers and ranchers from practices they implement to retain and increase soil carbon, reduce nitrous oxide formation, and reduce or capture methane emissions, relative to the costs incurred from implementing those practices. The larger the cost share covered by NRCS, the greater the incentive for farmers and ranchers to adopt them.

Direct economic benefits could include lower energy costs from reduced plowing, reduced expenses from fertilizer purchases, and savings from reduced energy purchases if a manure “digester” is installed to produce biogas (or revenues from sales of biogas to customers seeking “renewable natural gas”). Another benefit can be increased land productivity from reduced erosion and increased plant matter and moisture in soil. Costs can include greater expenses for weed control with reduced tillage, expenses for planting and subsequently plowing under cover crops, the costs of acquiring “precision agriculture” technologies (Balafoutus et al. 2017) for better control of fertilizer application, and the capital and operating cost of a manure digester (Uddin and Wright 2022).

Participation in Title II conservation programs can require significant effort by farmers and ranchers to assess their options, prepare their proposals, and establish a contract (McCann and Claassen 2016). Moreover, although NRCS provides technical assistance to farmers and ranchers, other factors can limit incentives to participate. One is concern about the economic benefits of a project for farmers and ranchers who are risk averse (Barham et al. 2014). Additional factors that could limit participation, especially for smaller farmers, include the limited time that NRCS conservation planners have available, uncertainty about funding windows and deadlines, and difficulties in assessing possible environmental benefits using USDA modeling tools developed initially for large-scale commodity production. A noneconomic hurdle also can arise if an agricultural community’s social norms and customs about what constitutes good farming are at odds with the conservation-oriented practices (Baumgart-Betz et al. 2012, Reimer et al. 2012).

4. Potential Greenhouse Gas Impacts

Proposed action plans to reduce US ag-GHG emissions have focused on estimating emission reductions from a particular set of policies and activities (see for example EDF 2022). At present there is no clear answer regarding the potential implications of increased Title II funding for GHG reductions.

Recent assessments of GHG emissions in agriculture have provided mixed predictions for the future. A report by Rhodium Group (2023) that includes the impacts of the IRA concludes that GHG emissions from agriculture and solid waste combined will be roughly flat over 2022-2035. The analytical framework for this assessment focuses primarily on GHG emissions related to energy. The assessment of the impacts on GHG emissions of the IRA by Bistline et al. (2023) also focuses on energy related emissions. A report from the Princeton University REPEAT project (Jenkins et al. 2023) shows declines in GHGs other than carbon dioxide and increases in carbon sequestration relative to a baseline without the IRA, but it does not break out figures for agriculture.

At a more micro level of analysis, there is evidence that implementing various changes in agricultural practices can reduce GHG emissions. Swan et al. (2021) qualitatively evaluates the potential GHG reductions from implementing 34 specific changes in agricultural practices utilized in NRCS programs. However, there can be uncertainty about the magnitude and timing of the emission reductions. A recent review of the economic incentives for these practices (Rejesus et al. 2021) finds that cover cropping can yield an adequate economic return to farmers if it is practiced over the longer term; the economic return from conservation tillage is more variable and site-specific. (As we discuss in a previous issue brief, development of publicly available modeling capacity able to provide more reliable estimates of policy impacts on ag-GHG emissions reductions should be a top priority).

Moreover, to have meaningful estimates of impacts on greenhouse gas emissions from Title II program support (or any other policy for reducing emissions), activities that would have been carried out anyway, given the other incentives farmers and ranchers face, need to be excluded. These activities are referred to as “non-additional.” For example, if cover cropping were a routine practice farmers used to reduce risks of weather variability, then there would be no rationale for supporting that activity in Title II programs, and reductions in emissions from cover cropping should not be ascribed to Title II support. Counting non-additional emission reductions overstates the impacts of the Title II programs. Claassen, Duquette, and Smith (2018) estimate that “structural practices” (such as installing buffer areas near water bodies or changing a farm’s manure management system) are more than 95 percent likely to be additional, while management practices such as conservation tillage adoption are less than 50 percent likely to be additional.

5. Questions about Title II Programs in the Context of Farm Bill Reauthorization

Numerous organizations have released policy Numerous organizations have released policy statements regarding the reauthorization of the Farm Bill, including positions on funding and implementation of Title II programs as well as on programs for renewable energy production in the agricultural sector (Title IX of the Farm Bill) and rural development (Title XI). Many advocates also have emphasized more equitable access to USDA programs by small and disadvantaged agricultural producers including Black, Latino, Native, and female farmers and ranchers. Examples of policy statements on Farm Bill reauthorization include papers from the American Farm Bureau Federation, Congressional Western Caucus, Environmental Defense Fund, Food and Agriculture Climate Alliance, National Farmers Union, and National Sustainable Agriculture Coalition.

The following list represents the authors’ views on some of the priority issues regarding Title II programs in the 2023 reauthorization.

1. How much funding will be approved for activities targeted at reducing agricultural greenhouse gas emissions in Title II? The answer will affect net economic benefits, take-up of mitigation measures, and ultimately, emission reductions.

Of particular importance in the 2023 reauthorization is how much of the funding in the IRA for agricultural greenhouse gas mitigation under Title II programs will become a permanent part of the appropriation. By the same token, the 2023 reauthorization will determine how much emphasis will be placed on more traditional conservation objectives like water quality, soil health, and species protection.

2. How will access to Title II funding be distributed among agricultural producer groups? The answer will have important equity and fairness implications.

Most of the Title II conservation programs are designed to provide additional benefits for small and beginning farmers and ranchers as well as farmers and ranchers who are socially disadvantaged or veterans. However, large-scale commodity crop and animal producers have tended to receive significant shares of conservation funding, if only due to their size. Some large operations may have both relatively low unit costs for reducing their greenhouse gas emissions, and large emissions to reduce. However, some of the significant funding they have received could be used by smaller operations with greater needs for government support.

3. What changes may USDA be required to undertake to strengthen the implementation of Title II programs? The answer will affect both take-up of mitigation measures and equity.

Three types of improvement in NRCS programs can be envisioned. Procedures for farmers and ranchers to access Title II programs could be streamlined and made more equitable. For example, some states have standardized the date on which applications for EQIP funding will be accepted, which helps to promote greater fairness in access to EQIP funding. Procedures for assessments of greenhouse gas mitigation through changes in agricultural practices could be improved through continued research. As noted, this is already a NRCS priority under the IRA. Practices utilized by farmers and ranchers to reduce greenhouse gas emissions also could be strengthened in various ways, including increasing their applicability in different contexts. In pursuit of that objective, NRCS could expand its partnerships with agronomic research institutions and other organizations, including those focused on supporting small and historically disadvantaged farmers and ranchers.

4. What links may be established between crop insurance eligibility or pricing and implementation of more sustainable agricultural practices?

Agricultural practices that improve soil health also may help to maintain and increase stored soil carbon. Linking crop insurance eligibility with implementation of sustainable agricultural practices seeks to create a financial incentive for a greater shift toward low-carbon and sustainable agricultural practices. For example, there is some evidence that greater use of cover cropping over an extended period of time lowers insurance claims for prevented planting (Won et al. 2023), though more research is needed on this topic. However, making such a linkage would be a sharp departure from treating crop insurance as a traditional part of the sector’s safety net.