A Clean Electricity Performance Program and Tax Credits Could Drive Emissions Reductions—But Alone Are Not Enough to Meet US Climate Goals

New analysis from a team at Resources for the Future finds that a carbon price alongside a clean electricity performance program and clean energy tax credits could help the United States halve emissions–but without a carbon price or other substantial climate policies, reductions fall short.

A new suite of modeling by Resources for the Future (RFF) provides insight into key provisions included in the proposed $3.5 trillion reconciliation bill wending its way through Congress.

The modeling details the emissions reduction potential of both clean energy tax credits and a Clean Electricity Performance Program (CEPP), versions of which have been included in draft text of the reconciliation package. The RFF analysis shows that, combined, these two policies could reduce energy-related carbon emissions to approximately 39 percent below 2005 levels in 2030, driving significant emissions reductions, but falling short of the United States’ Paris Agreement goals.

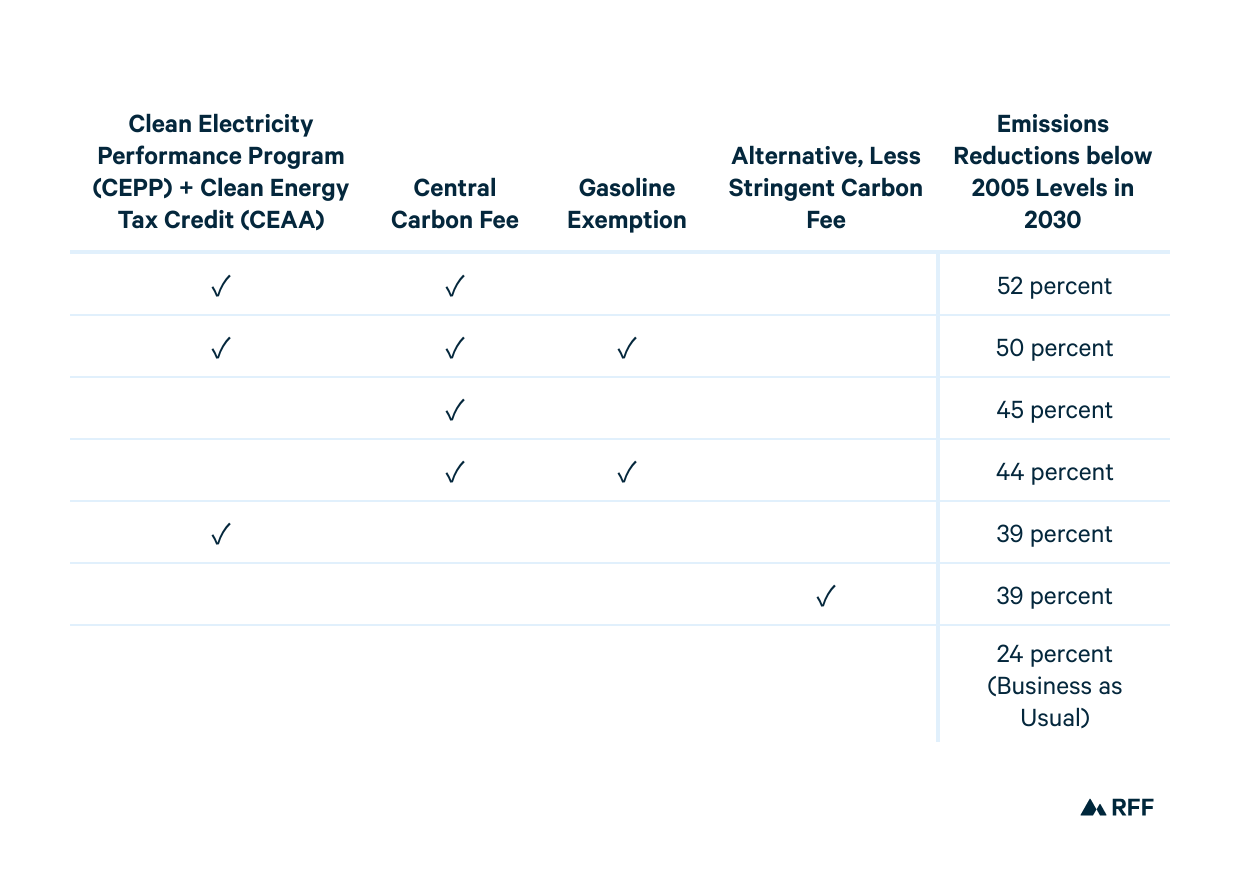

The issue brief analyses a number of policy scenarios:

- Tax incentives similar to the Clean Energy for America Act (CEAA) tax credits that target renewable energy; energy storage; energy efficiency; and clean light-, medium-, and heavy-duty vehicles; alongside clean electricity targets embodied in grants to retail electricity service entities of $150/MWh, similar to the proposed CEPP.

- A “central case” carbon fee scenario that places an economy-wide fee on carbon emissions. This scenario is further broken down into four policy cases:

- A carbon fee with and without an exemption for gasoline; and

- A carbon fee with and without an exemption for gasoline in addition to CEAA- and CEPP-type programs.

- An alternative, less stringent, economy-wide carbon fee that starts at $15 in 2023 and increases 5 percent annually (above inflation), without exemptions and without additional policies.

The researchers came to the following conclusions:

Notably, the authors find that a moderate carbon fee combined with the tax credits and a CEPP would reduce energy-related carbon dioxide emission to 50–52 percent below 2005 levels in 2030, depending on whether gasoline emissions are exempted from the fee. Emissions reductions at this level would meet the Biden administration’s Paris Agreement goals of halving emissions by 2030.

Relative to a “business as usual” scenario, most emissions reductions under each scenario would come from the power sector. The addition of carbon pricing drives meaningful reductions in the industrial sector, which the tax credits and CEPP do not achieve. Carbon pricing also generates moderate additional reductions in the transportation and buildings sectors.

“The clean energy tax credits and Clean Electricity Performance Program being considered in the reconciliation package provide a down payment on emissions reductions but are projected, by themselves, to fall short of the Biden administration’s aggressive climate targets,” RFF Fellow and coauthor Marc Hafstead said. “Carbon fees on energy-related carbon dioxide emissions remain a powerful tool to reduce emissions, and our analysis finds that carbon fees can achieve as much or more reductions than the proposed credits and CEPP can achieve on their own. Importantly, we find that combining carbon fees with the other policy proposals will meet our Paris Agreement targets for 2030.”

For more, read “Emissions Projections under Alternative Climate Policy Proposals,” by Fellow Marc Hafstead, Senior Research Associate Wesley Look, Research Analyst Nicholas Roy, Senior Fellow Karen Palmer, Senior Fellow Joshua Linn, and Fellow Kevin Rennert.

For more information on methodology and major modeling assumptions, please read the related April 2021 issue brief, “Emissions Projections for a Trio of Federal Climate Policies.”

Resources for the Future (RFF) is an independent, nonprofit research institution in Washington, DC. Its mission is to improve environmental, energy, and natural resource decisions through impartial economic research and policy engagement. RFF is committed to being the most widely trusted source of research insights and policy solutions leading to a healthy environment and a thriving economy.

Unless otherwise stated, the views expressed here are those of the individual authors and may differ from those of other RFF experts, its officers, or its directors. RFF does not take positions on specific legislative proposals.

For more information, please see our media resources page or contact Media Relations and Communications Manager Annie Tastet.